Scheduled outage for OSC Electronic Filing Portal on Thursday, April 25, 2024 from 6:00 to 11:00 pm (EST)

OSC Staff Notice: 52-722 - Report on Staff's Review of Non-GAAP Financial Measures and Additional GAAP Measures

OSC Staff Notice: 52-722 - Report on Staff's Review of Non-GAAP Financial Measures and Additional GAAP Measures

OSC Staff Notice 52-722

Report on Staff’s Review of Non-GAAP Financial Measures

and Additional GAAP Measures

1. Background and Purpose

CSA Staff Notice 52-306 Non-GAAP Financial Measures and Additional GAAP Measures (CSA Staff Notice 52-306) provides guidance to issuers that choose to disclose non-GAAP financial measures and additional GAAP measures. It was most recently updated on February 17, 2012 to provide guidance on the disclosure of additional GAAP measures presented under International Financial Reporting Standards (IFRS). Non-GAAP financial measures are not presented in the financial statements, however, with the adoption of IFRS, additional GAAP measures can be found within the financial statements when such presentation is relevant to an understanding of an entity's financial position, financial performance and cash flow.{1}

Non-GAAP financial measures are often found in public documents, such as Management Discussion & Analysis (MD&A), press releases, prospectus filings, websites and marketing materials. Additional GAAP measures presented in the financial statements under IFRS are also often found in the above mentioned documents. Issuers choose to present these measures as they believe they provide additional insight into an entity's overall performance, financial position, or cash flow.

Issuers in almost all industries use some type of a non-GAAP financial measure or an additional GAAP measure considered common to that particular industry. However, there is often no standard method to calculate the industry measure.

Staff of the Ontario Securities Commission (we or staff) recognise that non-GAAP financial measures may provide investors with supplemental information which helps them understand an issuer's financial performance. Nevertheless, investors must have a sufficient understanding of what these measures are and their relevance for decision making. Following the adoption of IFRS, staff have observed an increase in both the use of non-GAAP financial measures and additional GAAP measures.

To assess compliance with CSA Staff Notice 52-306 we reviewed the disclosure for 50 Ontario head office reporting issuers. Our reviews focused on the following:

• Where non-GAAP financial measures or additional GAAP measures were reported;

• Calculations of non-GAAP financial measures or additional GAAP measures;

• Presentations of non-GAAP financial measures or additional GAAP measures, and

• Disclosure of non-GAAP financial measures or additional GAAP measures.

- - - - - - - - - - - - - - - - - - - -

Summary of findings:

The results of our review were disappointing. Many issuers need to improve the quality of their disclosure related to non-GAAP financial measures or additional GAAP measures. Eighty-two percent of issuers reviewed committed to enhance the disclosure in their future filings including changes to address missing or inadequate quantitative reconciliations to the most directly comparable GAAP measure, disclosures explaining why the measures are meaningful to investors and the additional purposes, if any, for why management uses these measures and providing meaningful names when additional GAAP measures are presented in the financial statements. We are concerned that absent improvements in these areas, investors may be confused or potentially misled when non-GAAP financial measures or additional GAAP measures are not presented appropriately.

Specific findings and common areas of concern are discussed later in this notice as well as examples of deficient and entity-specific disclosure. We will continue to monitor and review disclosure of non-GAAP financial measures and additional GAAP measures as part of our normal course continuous disclosure review program.

- - - - - - - - - - - - - - - - - - - -

2. Staff Expectations

What is a non-GAAP financial measure?

A non-GAAP financial measure is a numerical measure of an issuer's historical or future financial performance, financial position or cash flow, that does not meet one or more of the criteria of an issuer's GAAP for presentation in financial statements, and either:

(i) excludes amounts that are included in the most directly comparable measure calculated and presented in accordance with the issuer's GAAP, or

(ii) includes amounts that are excluded from the most directly comparable measure calculated and presented in accordance with the issuer's GAAP.

Many non-GAAP financial measures are derived from profit or loss determined in accordance with an issuer's GAAP and, by omission or inclusion of selected items, present a more positive picture of financial performance. Staff understand that non-GAAP financial measures may provide investors with additional information to assist them in understanding key components of an issuer's financial performance. However, issuers should not present a non-GAAP financial measure in a way that confuses or obscures the most directly comparable measure calculated in accordance with the issuer's GAAP and presented in the financial statements.

What is an additional GAAP measure?

An additional GAAP measure presented in financial statements under IFRS is:

(i) a line item, heading or subtotal that is relevant to an understanding of the financial statements and is not a minimum line item mandated by IFRS{2} , or

(ii) a financial measure in the notes to financial statements that is relevant to an understanding of the financial statements and is a measure not presented elsewhere in the financial statements{3}.

IFRS requires certain minimum line items for financial statements and also requires presentation of additional line items, headings and subtotals when such presentation is relevant to an understanding of an entity's financial position and performance. IFRS also requires the notes to financial statements to provide information that is not presented elsewhere in the financial statements, but is relevant to an understanding of them. Because IFRS requires such additional measures, they are not considered non-GAAP financial measures. Judgement is required to determine whether a measure qualifies as an additional GAAP measure.

The key distinction is that a non-GAAP financial measure is not presented in the financial statements, whereas, an additional GAAP measure is presented in the financial statements.

We understand certain measures may sometimes be presented as additional GAAP measures within the financial statements, or sometimes presented as non-GAAP financial measures outside of the financial statements. For example, EBITDA is generally a non-GAAP measure presented outside the financial statements, however, in some cases it may be possible for an issuer to present EBITDA as a subtotal in its statement of comprehensive income, as an additional GAAP measure. Similarly, it may be possible to present EBIT as a subtotal in the statement of comprehensive income. Presenting EBITDA or EBIT as a subtotal would only be appropriate if the amounts for interest, taxes, depreciation and amortization, as applicable, are clearly identified on the statement of comprehensive income and presented below the subtotal. EBITDA or EBIT should only be presented as separate line items in an issuer's financial statements if they are relevant to understanding an issuer's financial performance.{4}.

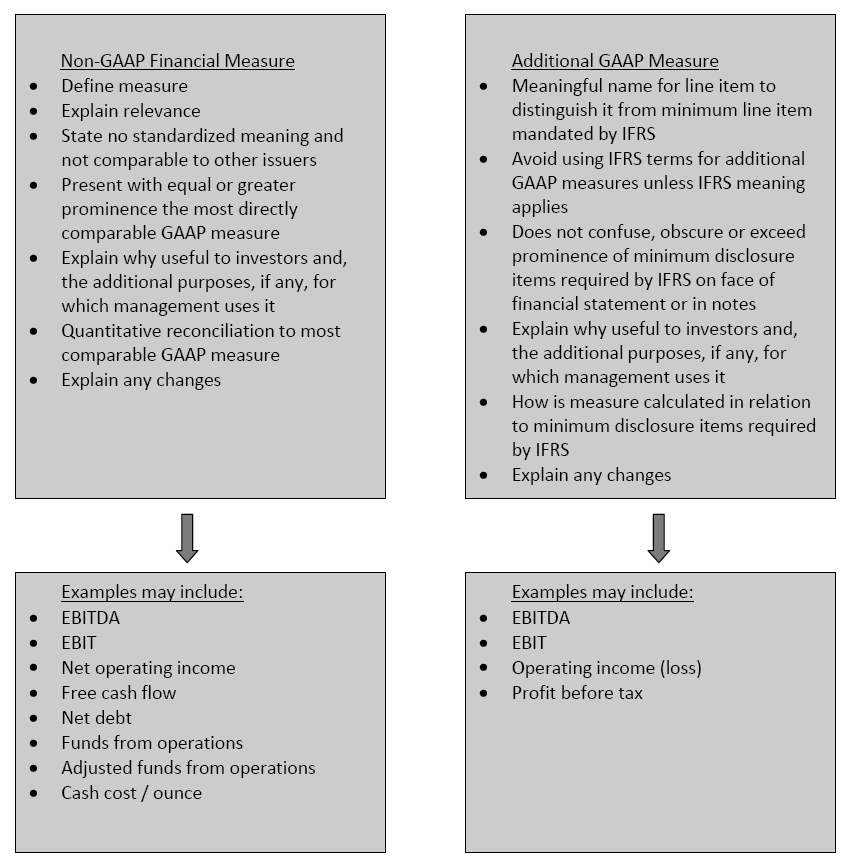

Disclosure expectations (CSA Staff Notice 52-306)

3. What we found

Staff reviewed 50 Ontario head office reporting issuers, all who had disclosure of non-GAAP financial measures, and some which had disclosure of additional GAAP measures. Staff identified concerns in the disclosure of 86% of the issuers reviewed, and followed up on these concerns through comment letters.

Our review of the remaining 14% of issuers did not raise any substantive concerns relating to their presentation of non-GAAP financial measures or additional GAAP measures. Non-GAAP financial measures were generally found in the MD&A, press releases and investor presentations on issuers' websites, while additional GAAP measures were found in the financial statements. The issuers reviewed were across seven different industry groups (real estate, retail, manufacturing, financial services, mining, technology and communications), and issuers consisted of both TSX and TSXV issuers, though we observed that TSX issuers use non-GAAP measures more often than venture issuers.

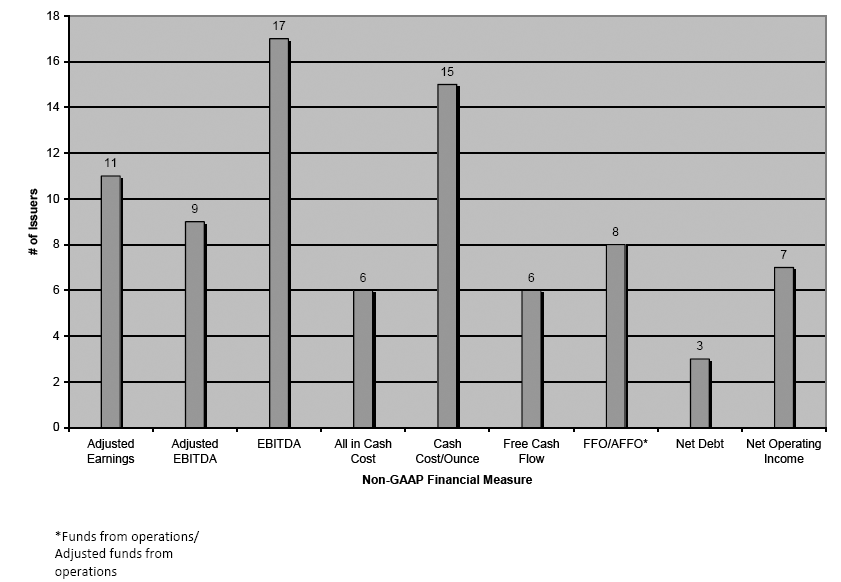

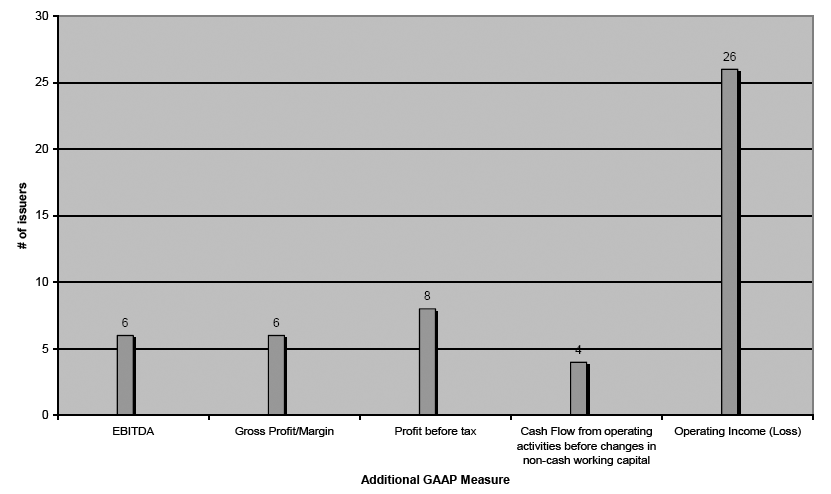

The charts below summarize the more common non-GAAP financial measures and additional GAAP measures used by issuers. Some issuers used multiple non-GAAP financial measures and/or additional GAAP measures.

Commonly used Non-GAAP Financial Measures

Commonly used Additional GAAP Measures

In some instances, issuers presented "income before the undernoted" on the face of the statement of comprehensive income as an additional GAAP measure. Staff believe that this name is not meaningful nor relevant as this term does not sufficiently describe the measure as it does not tell users which elements are missing from the IFRS measure of income. In our view, a subtotal of "income before the undernoted" or similar measure does not have meaning or relevance and should not be presented in the financial statements.

Some issuers presented gross profit or gross margin on the face of the statement of comprehensive income. Although this is a widely recognized measure used to represent revenue less cost of sales, staff noted some issuers excluded items from the cost of sales line item that were in fact representative of the cost of sales, such as an inventory write-down for a manufacturing entity. Some issuers also included items which were not representative of cost of sales in the subtotal that are normally not regarded as cost of sales. If an issuer adjusts costs of sales by including or excluding additional items, this should be clearly disclosed. It would also no longer be appropriate to label the line item as cost of sales or the resulting subtotal as gross profit or gross margin, as this may confuse or mislead investors.

4. Overall Findings

Based on our reviews, we identified the following areas where improvements are needed:

• explain the objectives for using the non-GAAP financial measures or the additional GAAP measure, including why the measures are meaningful for investors and the additional purposes, if any, for why management uses the measures;

• provide a clear quantitative reconciliation between the non-GAAP financial measure and its most directly comparable GAAP measure;

• provide meaningful names for additional GAAP measures that are not confusing; and

• disclose how the additional GAAP measures are calculated in relation to minimum disclosure items required by IFRS.

Some of the common occurring concerns as well as the frequency of deficiencies noted in each area of our review are outlined below.

Generally -- Non-GAAP financial measures

• Issuers generally provide an explanation for their use of non-GAAP financial measures, which contain boilerplate language that is not meaningful. For example, the explanations often consist of assertions that these measures better communicate performance, management thinks shareholders or analysts prefer these measures or that it is industry practice to use these measures. Approximately 10% of issuers provided boilerplate disclosures in their MD&A or press releases. We expect issuers to fully discuss the meanings of these measures and the reasons why management believes these measures are useful to investors. Enhanced disclosure in this area will allow investors to understand how these measures are used to evaluate the issuer's financial performance.

• 15% of issuers gave greater prominence to non-GAAP measures rather than the most directly comparable GAAP measure by highlighting or bolding the non-GAAP financial measure or presenting the non-GAAP financial measure prior to the most directly comparable GAAP measure.

• 20% of issuers did not clearly reconcile the non-GAAP financial measure to the most directly comparable GAAP measure, or did not disclose a reconciliation at all.

• Non-GAAP financial measures are sometimes used to exclude or include non-recurring, infrequent or unusual items. Even when adequately disclosed, such use of non-GAAP financial measures can still be inherently misleading as it may confuse readers into believing an issuer's financial performance has been more positive than actual. In staff's view, non-GAAP financial measures generally should not describe adjustments as non-recurring, infrequent or unusual, when a similar loss or gain is reasonably likely to occur within the next two years or occurred during the prior two years. Staff found that 15% of issuers identified adjustments as being non-recurring, unusual or infrequent when a similar adjustment occurred during the prior two years.

Generally -- Additional GAAP measures

• Approximately 20% of issuers included additional line items on the face of the financial statements that were not considered meaningful in light of the name given to the measure, such as "income before the undernoted" or "income before operating expenses."

• Of the issuers that disclosed additional GAAP measures, 75% of them did not adequately explain why the additional GAAP measure provides relevant information to investors, and how it facilitates the investor to better understand the issuers financial position and performance.

• 15% of issuers did not adequately disclose how the additional GAAP measure was calculated in relation to the minimum disclosure items required by IFRS on the face of the financial statements.

• 77% of issuers included a subtotal for operating income as an additional GAAP measure on the statement of comprehensive income; however, 15% of these issuers excluded expenses that were operating in nature from this subtotal.

5. Press Releases / Website Materials

Approximately 30% of issuers reviewed failed to identify non-GAAP financial measures used in their earnings releases, marketing materials or investor presentations as non-GAAP financial measures. These disclosure documents did not contain the disclosure items set out in CSA Staff Notice 52-306. Measures like EBITDA and EBIT are common, however, they are not considered to be measures that are defined by GAAP and therefore have no standardized definition for these measures. For example, some issuers adjust from EBITDA non-recurring charges and minority interests, while others do not. 33% of issuers did not explain why non-GAAP financial measure provide useful information to investors and the additional purposes, if any, for which management uses the non-GAAP financial measures.

6. Management Discussion & Analysis

Overall, staff found that issuers were generally in compliance with CSA Staff Notice 52-306 as it relates to non-GAAP financial measures in their MD&A filings.

Staff noted instances where issuers presented additional GAAP measures on the face of the financial statements, but did not discuss the additional GAAP measure in the MD&A. Additional GAAP measures are presented if they are relevant to understanding the financial position, financial performance or cash flow of the issuer. MD&A is an explanation, through the eyes of management, of how an issuer performed during the period covered by the financial statements and of the issuer's financial condition. MD&A supplements the financial statements and is used to improve the financial disclosure by providing a balanced discussion of the issuer's financial performance. If an issuer presents additional GAAP measures in its financial statements, the MD&A should generally discuss and analyze these measures and explain why they are relevant to a user of the financial statements.

7. Key Performance Indicators (KPIs)

Staff noted a number of issuers present KPIs such as adjusted earnings, net debt, debt to gross book value, sales per square foot and interest coverage ratios. In instances where KPIs contained financial information sourced from the financial statements, we observed a number of issuers did not identify these KPIs as non-GAAP financial measures. In our view, these KPIs are the same as ratios used by an issuer. CSA Staff Notice 52-306 states that ratios such as return on assets that uses an amount for assets, profit or loss that differs from the amounts presented in the financial statements are non-GAAP financial measures. Even though a ratio may not have a directly comparable GAAP measure required under IFRS, this does not automatically exclude the ratio from being a non-GAAP financial measure. Similar to disclosure expectations for non-GAAP financial measures, ratios should be clearly defined, the issuer should disclose how the ratio provides useful information to investors, why management uses the ratio and a reconciliation of how the ratio has been calculated in relation to line items in the financial statements.

We understand KPIs may be used by management to assess the financial performance of the issuer and the KPIs may also be requested by sophisticated investors to assess the financial performance of the issuer year over year. KPIs generally do not have standardized meanings, so it is important to ensure that they are defined clearly and used consistently from period to period. Issuers should carefully consider whether KPIs are a non-GAAP financial measure and, if so, they should include the disclosures outlined in CSA Staff Notice 52-306. By providing the disclosures of CSA Staff Notice 52-306 for KPIs, issuers would provide greater clarity and transparency regarding the actual components used for calculating the KPI.

Further, additional GAAP measures such as debt to equity ratios or free cash flow are disclosed in the notes to the financial statements to illustrate that the issuer is in compliance with debt covenants or credit agreements. While this disclosure provides relevant information to investors, if a reader cannot easily determine how a measure is calculated in relation to the minimum disclosure items required by IFRS in the financial statements, the issuer should discuss and disclose how the measure is calculated.

8. Examples

The following section provides examples of boilerplate and entity-specific disclosures as well as numerical examples which illustrate the use of non-GAAP financial measures and additional GAAP measures.

Example 1

During our reviews, we noted a number of issuers provided boilerplate type disclosure about non-GAAP financial measures, which does not provide meaningful information to investors. The issuer in this boilerplate example did not explain why the non-GAAP financial measure provides useful information to investors and the additional purposes, if any, for which management uses the non-GAAP financial measure.

- - - - - - - - - - - - - - - - - - - -

Example of boilerplate disclosure:

EBITDA is a non-GAAP financial measure, which is defined as earnings before income tax expense, financing costs, depreciation and amortization, and impairment charges. EBITDA is used to provide additional useful information to investors and analysts. Other issuers may calculate EBITDA differently.

- - - - - - - - - - - - - - - - - - - -

A better example of disclosure for non-GAAP financial measures would be as follows, as the issuer disclosed why the non-GAAP financial measure provides useful information to investors and why management uses the non-GAAP financial measure.

- - - - - - - - - - - - - - - - - - - -

Example of entity-specific disclosure:

Adjusted EBITDA is a non-GAAP financial measure, which is defined as earnings before income tax expense, financing costs, depreciation and amortization, and impairment charges.

Management believes that Adjusted EBITDA is an important indicator of the issuers ability to generate liquidity through operating cash flow to fund future working capital needs, service outstanding debt, and fund future capital expenditures and uses the metric for this purpose. The exclusion of impairment charges eliminates the non-cash impact. Adjusted EBITDA is also used by investors and analysts for the purpose of valuing an issuer. The intent of Adjusted EBITDA is to provide additional useful information to investors and analysts and the measure does not have any standardized meaning under IFRS. Adjusted EBITDA should therefore not be considered in isolation or used in substitute for measures of performance prepared in accordance with IFRS. Other issuers may calculate Adjusted EBITDA differently.

- - - - - - - - - - - - - - - - - - - -

Example 2

This is an example of boilerplate type disclosure for non-GAAP financial measures, as the issuer did not explicitly state that operating income before impairment items was a non-GAAP financial measure. Once again this disclosure does not provide meaningful information to investors.

- - - - - - - - - - - - - - - - - - - -

Example of boilerplate disclosure:

Our operating income before impairment items rose 31%, reaching a new peak of $101 million.

- - - - - - - - - - - - - - - - - - - -

A better example of disclosure for non-GAAP financial measures would be as follows, as the issuer clearly disclosed the non-GAAP financial measure does not have a standardised meaning and is unlikely to be comparable to similar measures presented by other issuers.

- - - - - - - - - - - - - - - - - - - -

Example of entity-specific disclosure

Our profit for the fiscal year was $50 million compared to $31 million in the previous fiscal year. Operating income before impairment (OIBI) rose 31%, reaching a new peak of $101 million. OIBI of the previous fiscal year was $77 million.

OIBI is a non-GAAP measure and is mainly derived from the consolidated financial statements but does not have any standardized meaning prescribed by IFRS. Therefore it is unlikely to be comparable to similar measures presented by other issuers.

OIBI is used by management to evaluate the performance of its operations based on a comparable basis which excludes impairment items because they are non-recurring. When an impairment item occurs in more than two consecutive fiscal years, it is no longer considered to be non-recurring by management.

- - - - - - - - - - - - - - - - - - - -

Example 3

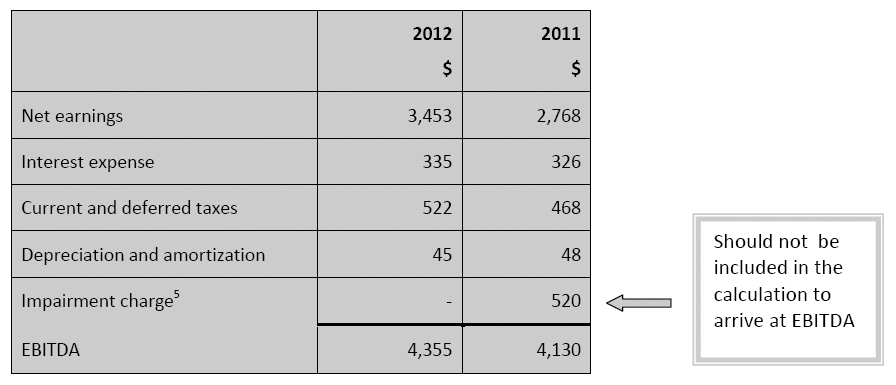

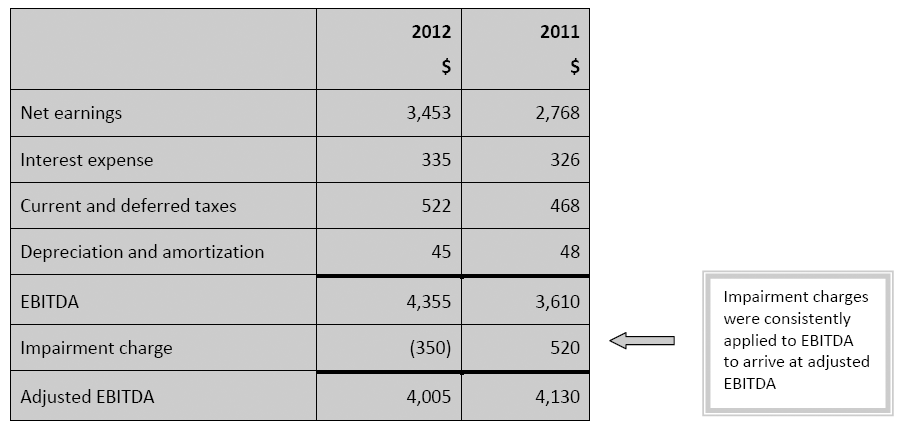

This example illustrates an adjustment to EBITDA for an impairment charge which can be seen as potentially misleading. EBITDA is a commonly understood acronym that means "earnings before interest, taxes, depreciation and amortization". However, in this example we note the reported EBITDA contains "other" items in addition to the commonly understood adjustments. Staff are of the view that when additional adjustments such as restructuring or impairment charges are included in the EBITDA calculation, then the measure could be seen as potentially misleading or confusing to investors. We observed additional adjustments are often made to EBITDA to make the metric look more positive to investors. If the components of calculating EBITDA differ from the understood meaning of the acronym, then investors can be easily misled. Based on our reviews, staff noted that EBITDA often included items that are inconsistent with the understood meaning. For this reason, issuers should clearly disclose that the non-GAAP financial measure is unlikely to be comparable to similar measures presented by other issuers.

Example of potentially misleading EBITDA:

5 The issuer did not include the reversal of $350 in 2012

In the example above, when calculating EBITDA, an impairment charge was included for the 2011 year, however, in 2012 there was a reversal of the impairment of $350 that was not included in the calculation. By not including the reversal of the impairment charge in 2012, this issuer is not presenting EBITDA on a consistent basis year over year as the issuer is including the positive adjustments but excluding the negative adjustments. The reversal would have resulted in a lower EBITDA for 2012 than the 2011 EBITDA. This is confusing and potentially misleading to investors. EBITDA should be presented on a consistent basis year over year.

The following table illustrates better and more transparent disclosure as the impairment charges have been applied consistently year over year. As well, as explained earlier, the impairment charges are no longer part of the EBITDA calculation and have been applied to EBITDA to arrive at Adjusted EBITDA.

Revised to better reflect EBITDA/Adjusted EBITDA:

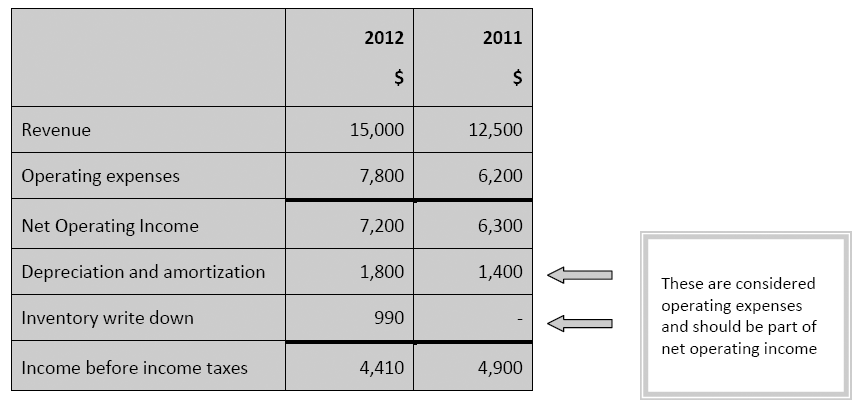

Example 4

In the following example, an issuer reported a subtotal for net operating income as an additional GAAP measure on the face of the consolidated statement of operations. We noted this line item was not representative of activities that would normally be viewed as operating in nature. For example, the issuer excluded depreciation and amortization expenses and inventory write down from the net operating income subtotal on the basis that these items do not involve cash or because they occur infrequently. However, if an issuer chooses to present a subtotal for net operating income, it should be representative of the activities that would normally be regarded as operating in nature.{6} We believe these line items are operating in nature and excluding them would be misleading and would impair the comparability of the financial statements.

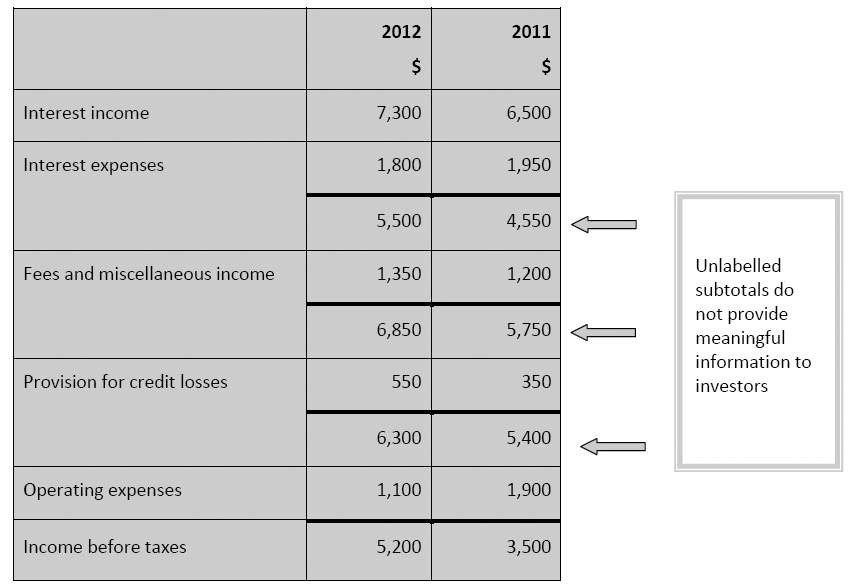

Example 5

This example highlights where an issuer reported a number of subtotals on the statement of comprehensive income, however, the subtotals were not labelled and did not provide additional information to investors. Subtotals should be provided if they are relevant to an understanding of the issuer's financial performance. Moreover, additional GAAP measures such as subtotals should generally be discussed by the issuer in the MD&A, as the MD&A should help investors understand what the financial statements show and do not show. In this case, there was no corresponding MD&A discussion to subtotals noted, providing no clarity on the relevance of these measures.

Example 6

The example below illustrates how an issuer uses KPIs, but does not identify these KPIs as non-GAAP financial measures.

- - - - - - - - - - - - - - - - - - - -

Example of boilerplate disclosure:

Management uses key performance indicators such as interest coverage ratios and debt to gross assets to assess our ability to meet our financing obligations.

- - - - - - - - - - - - - - - - - - - -

The issuer in the entity-specific example identified KPIs as a non-GAAP financial measure which provides meaningful information to investors.

- - - - - - - - - - - - - - - - - - - -

Example of entity-specific disclosure:

Management uses key performance indicators such as interest coverage ratios and debt to gross assets to assess our financing needs and our ability to meet short term and long term obligations. Interest coverage ratio is defined as EBITDA/interest expense and is used to measure how the company can pay interest on outstanding debt. Debt to gross assets is defined as short term debt plus long term debt plus debt in a joint venture that is equity accounted for, divided by total assets (tangible and intangible) plus assets of the joint venture that is equity accounted, and is used to measure debt within the company including joint venture operations. Although these KPIs are expressed as ratios, they are non-GAAP financial measures that do not have a standardized meaning and may not be comparable to similar measures used by other issuers. These measures are not recognized by IFRS, however, they are meaningful as they indicate the issuer's ability to meet their obligations on an on-going basis. These measures are useful to investors as they indicate whether the company is more/less leveraged than the prior year. Below is a reconciliation of debt to gross assets expressed as a ratio from the line items in the IFRS financial statements.

Debt to gross book value

Debt per F/S

2,580

Debt per JV

955

Total debt

3,535

Total assets per F/S

9,777

Assets per JV

1,850

Total assets

11,627

Debt to total assets

30.4%

- - - - - - - - - - - - - - - - - - - -

9. Conclusions

There is still room for significant improvement for issuers disclosing non-GAAP financial measures or additional GAAP measures. Investors may find non-GAAP financial measures and additional GAAP measures useful, however, it is critical to ensure there is complete transparency such that these measures are easily understood and are relevant.

Staff remind issuers of their responsibility to ensure that non-GAAP financial measures and additional GAAP measures publicly disclosed are not misleading. Staff also remind certifying officers of their obligations under National Instrument 52-109 Certification of Disclosure in Issuers' Annual and Interim Filings to make certifications regarding misrepresentations, fair presentation, and disclosure controls and procedures.

We remind issuers that regulatory action may be taken against issuers that disclose information in a manner considered misleading and therefore potentially harmful to the public interest. In these cases, staff may request a restatement of the non-compliant filing and/or potential enforcement action.

This Notice supplements CSA Staff Notice 52-306 and we encourage issuers to refer to it when presenting non-GAAP financial measures or additional GAAP measures.

10. Questions

If you have any additional questions, please feel free to contact any of the following:

- - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - -

{1} See CSA Staff Notice 52-306 for a complete discussion of the presentation of additional GAAP measures

{2} IAS 1 paragraphs 55 and 85

{3} IAS 1 paragraph 112(c)

{4} See CSA Staff Notice 52-306 for a complete discussion of the use of EBITDA and EBIT as an additional GAAP measure

{6} IAS 1, Basis for Conclusions paragraph 56