Register today for OSC Dialogue 2024: Inviting, thriving and secure capital markets

Alliance Atlantis Communications Inc., Mr. Michael MacMillan, Mr. Seaton McLean, Mr. Edward Riley and Mr. Peter Sussman - cl. 104(2)(c)

Headnote

Clause 104(2)(c) - indirect issuer bids resulting from a reorganization involving issuer and its significant shareholders - after the reorganization, the issuer will have the same number of shares issued and outstanding, and each shareholder will have the same number of shares and same relative ownership that they owned prior to the reorganization - shareholders to indemnify and reimburse issuer for certain costs and liabilities associated with reorganization - no adverse economic impact on or prejudice to issuer or public shareholders - issuer exempt from requirements of sections 95, 96, 97, 98 and 100 of the Act

Ontario Statutes Cited

Securities Act, R.S.O. 1990, c. S.5, as am., ss. 89(1), 92, 95, 96, 97, 98, 100 and 104(2)(c)

Ontario Rules Cited

Rule 61-501 -- Insider Bids, Issuer Bids, Going Private Transactions and Related Party Transactions

IN THE MATTER OF

THE SECURITIES ACT, R.S.O. 1990,

CHAPTER S.5, AS AMENDED (the "Act")

AND

IN THE MATTER OF

ALLIANCE ATLANTIS COMMUNICATIONS INC.,

MR. MICHAEL MACMILLAN, MR. SEATON MCLEAN,

MR. EDWARD RILEY AND MR. PETER SUSSMAN

ORDER

(CLAUSE 104(2)(C))

UPON the application (the "Application") of Alliance Atlantis Communications Inc. ("AACI") and Mr. Michael MacMillan, Mr. Seaton McLean, Mr. Edward Riley and Mr. Peter Sussman (Messrs. MacMillan, McLean, Riley and Sussman are individually a "Principal" and collectively the "Principals") to the Ontario Securities Commission (the "Commission") for an order pursuant to clause 104(2)(c) of the Act that certain indirect acquisitions by AACI of its Class A voting shares (the "Class A Voting Shares") and Class B non-voting shares (the "Class B Non-Voting Shares"), pursuant to a proposed reorganization (the "Reorganization") described in paragraph 14 below, are exempt from the requirements of sections 95, 96, 97, 98 and 100 of the Act (the "Issuer Bid Requirements");

AND UPON considering the Application and the recommendation of the staff of the Commission;

AND UPON AACI and the Principals having represented to the Commission as follows:

1. AACI is a corporation incorporated under the laws of Canada and is a reporting issuer under the Act not in default of any requirements of the Act or the regulations made thereunder.

2. The authorized capital of AACI consists of an unlimited number of Class A Voting Shares and unlimited number of Class B Non-Voting Shares. As of December 31, 2004, 2,845,071 Class A Voting Shares and 40,387,164 Class B Non-Voting Shares were issued and outstanding.

3. The Class A Voting Shares and Class B Non-Voting Shares are listed on The Toronto Stock Exchange ("TSX"). The Class B Non-Voting Shares are listed on The NASDAQ National Market.

4. The Class A Voting Shares are convertible at any time, at the option of the holder, into Class B Non-Voting Shares on a one-for-one basis.

5. The Principals are the shareholders of Stampco Holdings Inc. ("Stampco"), which holds, directly and indirectly, Class A Voting Shares.

6. Atcan Investments (1998) Inc. ("Atcan"), a corporation incorporated under the laws of Ontario, directly holds 2,118,749 Class A Voting Shares.

7. Stampco, a corporation incorporated under the laws of Ontario, directly holds 321,000 Class A Voting Shares.

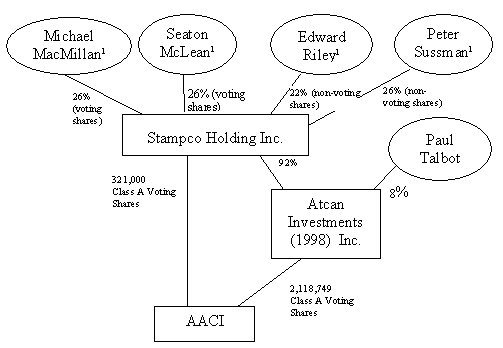

8. The current shareholders of Stampco and Atcan are as described in the chart below:

1 Messrs. McLean and MacMillan hold voting shares of Stampco. Messrs. Riley and Sussman hold non-voting shares of Stampco.

9. As indicated above, the Principals collectively hold 100% of the voting shares of Stampco, which in turn owns 100% of the voting shares of Atcan.

10. As of December 31, 2004, the 2,439,749 Class A Voting Shares held by Stampco and Atcan collectively represent 85.8% of AACI's issued and outstanding Class A Voting Shares.

11. In December 2003, Messrs. Sussman and McLean ceased to be employed by AACI. They desire to hold AACI shares directly in order to deal with them independently of the other Principals.

12. The Principals are proposing to collapse the Stampco/Atcan holding company structure (the "Reorganization"). The Reorganization will allow the Principals to exchange their shares in Stampco and Atcan for their proportionate direct interest in shares of AACI. This will permit each Principal to deal directly with the AACI shares currently held by him indirectly through Stampco and Atcan so that he may retain or dispose of his holdings in AACI as he chooses, subject to the fact that the Class A Voting Shares will be held by Newco, which is described below.

13. Under current contractual arrangements in place between the Principals and Stampco, the Principals have a mechanism in place which would result in them holding AACI shares directly. However, triggering this mechanism would have potentially prejudicial consequences to AACI. Therefore, the Principals have permitted AACI to be involved in the Reorganization to avoid causing harm to AACI as a result of the transactions the Principals propose to undertake. Specifically, AACI has been involved in structuring the Reorganization to attempt to ensure that it does not result in an acquisition of control of AACI under:

(a) the Income Tax Act (Canada) which could have harmful consequences to AACI's tax position; or

(b) Canadian Radio-television and Telecommunications Commission ("CRTC") rules and regulations, which could also be harmful to AACI.

14. The Reorganization entails a number of transactions which are summarized as follows:

(a) Stampco and Atcan will be amalgamated into "Amalco". The shares of each class of shares of Stampco and Atcan will be exchanged for non-voting common shares of Amalco. The two Principals who currently, directly and indirectly, hold all voting shares of Stampco and Atcan, Messrs MacMillan and McLean, will also receive special voting non-equity shares of Amalco representing 100% of the Amalco voting shares.

(b) Messrs MacMillan and McLean will incorporate a new corporation under the Business Corporations Act (Ontario) ("Newco"). Each of Messrs MacMillan and McLean will subscribe for an equal number of voting shares of Newco. Mr. MacMillan will transfer his non-voting Amalco shares and Class A Voting Shares he holds directly to Newco in exchange for shares of Newco. Mr. McLean will transfer a portion of his non-voting Amalco shares to Newco in exchange for shares of Newco. Messrs MacMillan and McLean will hold all of Newco's issued and outstanding shares.

(c) The non-voting shareholders of Amalco (other than Newco) will transfer their non-voting common shares of Amalco to AACI in exchange for AACI issuing Class B Non-Voting Shares. Newco will transfer its non-voting common shares of Amalco to AACI in exchange for AACI issuing Class A Voting Shares.

(d) Amalco will convert Class A Voting Shares directly held by it into Class B Non-Voting Shares pursuant to the terms and conditions of the Class A Voting Shares. Amalco will also sell Class A Voting Shares to Newco.

(e) Amalco will be wound up into AACI and the AACI shares held by it will be cancelled.

(f) The Reorganization will include the following specific steps involving AACI, as described in (c) above:

(i) AACI will receive non-voting common shares of Amalco from Messrs McLean, Riley, Sussman and Talbot. As full consideration for receiving such Amalco shares, AACI will issue, from treasury, Class B Non-Voting Shares; and

(ii) AACI will receive non-voting common shares of Amalco from Newco. As full consideration for receiving such Amalco shares, AACI will issue, from treasury, Class A Voting Shares.

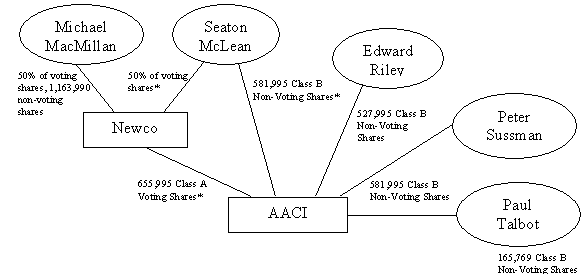

(g) The shareholdings of the Principals and Mr. Paul Talbot following the Reorganization are as described in the chart below:

* The total number of Class A Voting Shares and Class B Non-Voting Shares held by Mr. McLean and Newco is as described in the chart above, however, the exact number of Class A Voting Shares or Class B Non-Voting Shares to be held by Mr. McLean and Newco may change slightly. Mr. McLean may also hold a small number of Newco non-voting shares.

**The ownership structure chart does not include other Class B Non-Voting Shares and options held separately by the Principals and Mr. Talbot.

15. The aggregate number of AACI shares held, directly or indirectly, by the Principals and Mr. Talbot will not change as a result of the Reorganization. Prior to the Reorganization, the Principals and Mr. Talbot indirectly held 2,513,749 Class A Voting Shares. Following the Reorganization, the Principals and Mr. Talbot will continue to hold 2,513,749 shares of AACI but there will be fewer Class A Voting Shares and the balance will be Class B Non-Voting Shares.

16. The fact that the number of Class A Voting Shares will be reduced while the number of Class B Non-Voting Shares will increase is not prejudicial to the public interest as the terms and conditions of the Class A Voting Shares provide the holders thereof the option, at their discretion and at any time, to convert Class A Voting Shares into Class B Non-Voting Shares.

17. The Principals will indemnify AACI from (i) any liabilities in Amalco, the company acquired by AACI as a result of the Reorganization; (ii) for breaches of their representations, warranties or covenants contained in the agreements by which the exchange of shares is implemented; and (iii) for liability for taxes arising directly as a result of particular steps in the Reorganization, including the cancellation of shares on the winding up on Amalco, but excluding any tax liability that is attributable to any acquisition of control of Amalco or AACI.

18. The Corporate Governance Committee of AACI's Board of Directors has determined that the Principals will pay 25% of the costs of the proposed Reorganization, which in the view of AACI is fair and reasonable in the circumstances in light of the benefits accruing to AACI and the related costs in implementing the Reorganization in the manner contemplated. AACI believes that all of the members of the Corporate Governance Committee of the Board of Directors of AACI are independent within the meaning of Part 7 of the OSC Rule 61-501.

19. The Reorganization is subject to (i) approval of the Corporate Governance Committee of the Board of Directors of AACI comprised of non-management directors; (ii) approval by the Board of Directors of AACI (with those directors who are also Principals declaring their interest and abstaining from voting); (iii) acceptance of notice of the Reorganization by the TSX (which has been received); and (iv) confirmation from the CRTC that the Reorganization does not result in a change of control of AACI (which has been received).

20. AACI's offer to purchase Amalco's non-voting common shares (the "Offer") in exchange for issuing its Class B Non-Voting Shares and Class A Voting Shares, as described at paragraph 14(f) above will constitute an issuer bid under subsection 89(1) and section 92 of the Act in that it will constitute an indirect offer by AACI for its Class A Voting Shares and Class B Non-Voting Shares. The Offer will not be an exempt issuer bid under the Act.

AND UPON the Commission being satisfied that to do so would not be prejudicial to the public interest;

IT IS ORDERED pursuant to clause 104(2)(c) of the Act that the Offer to be made by AACI as part of the Reorganization be exempt from the Issuer Bid Requirements.

March 11, 2005.

|

"Paul Moore"

|

"Wendell S. Wigle"

|