Register today for OSC Dialogue 2024: Inviting, thriving and secure capital markets

Notice of Initial Operations Report and Request for Feedback - CX2 Canada ATS

Chi-X Canada ATS Limited (Chi-X) has announced its plans as an alternative trading system to begin operating its second Canadian trading facility CX2 Canada ATS (CX2). This Notice of Initial Operations Report is being published in accordance with the process set out in OSC Staff Notice 21-706 -- Marketplaces' Initial Operations and Material System Changes. Pursuant to OSC Staff Notice 21-706, market participants are invited to provide the Commission with feedback on the information provided in this Notice.

Staff request for specific comment

As part of the manner in which orders will match for execution within CX2, Chi-X has proposed that all orders will be eligible for broker preferencing by default, with the ability for subscribers to elect to opt-out of broker preferencing on an order-by-order basis. The option to participate in broker preferencing will also be extended to orders marked as anonymous whereby matching will be based on the underlying Broker ID. OSC staff (Staff) are not aware of any other visible equity marketplace in Canada that allows anonymous orders to benefit from participation in broker preferencing. Staff are seeking specific comment as to whether CX2 should be permitted to extend broker preferencing to apply to those orders that are marked anonymous and whether this practice raises public interest concerns.

Submission of feedback

Feedback on the Initial Operations Notice should be in writing and submitted by Monday, December 10, 2012 to:

Market Regulation Branch

Ontario Securities Commission

Suite 1903, Box 55

20 Queen Street West

Toronto, ON M5H 3S8

Fax (416) 595-8940

Email: [email protected]

And to:

Matthew Thompson

Chief Compliance Officer

Chi-X Canada ATS Limited

130 King St. W, Suite 2105

Toronto, ON M5X 1E3

Email: [email protected]

Comments received will be made public on the OSC website. Upon completion of the review by Staff, and in the absence of any regulatory concerns, notice will be published to confirm the completion of Staff's review and to outline the intended start date for the operation of CX2. Chi-X has previously announced its intention to commence operations of CX2 in the first quarter of 2013, pending regulatory approval.

CX2 CANADA ATS ("CX2")

NOTICE OF INITIAL OPERATIONS REPORT AND REQUEST FOR FEEBACK

Overview

Chi-X Canada ATS Limited will begin operating its second Canadian trading facility, CX2, that will offer a continuous auction market offering on-marketplace internalization opportunities through broker-preferencing for all order types including anonymous orders. Given the approval of the Maple transaction, we believe it is important to have a viable competitor in the market offering unique market structure and pricing schedule. CX2 will provide existing Chi-X Canada ("CXC") subscribers with the opportunity to benefit from broker-preferencing while not forfeiting the use of Chi-X Canada technology, order types and features.

Becoming a CX2 Subscriber

The platform will be made available to registered Investment Dealers which are members of IIROC in good standing.

To facilitate the subscription process, current CXC subscribers may sign a representation to maintain the existing terms and conditions of their current CXC subscriber agreement with respect to their access to CX2. New CX2 subscribers that are not currently CXC subscribers must sign the CX2 subscriber agreement in accordance with National Instrument 21-101.

Access to CX2 ATS

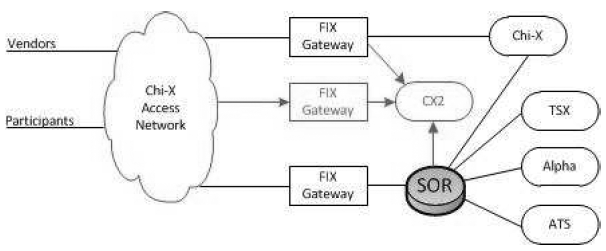

CX2 and CXC operate independently of one another. As shown in the diagram above, CX2 subscribers may select to establish a direct connection to CX2 or, as a CXC subscriber, can access CX2 through their existing CXC FIX Sessions or through the Chi-X Canada's Smart Order Router. CXC subscribers that become CX2 subscribers can access the facility using their existing connection. There is no requirement for CX2 subscribers to also become subscribers of CXC.

CX2 uses the Financial Information eXchange ("FIX") protocol. All orders are entered via FIX into the Core Matching Engine that supports all UMIR required fields.

Order Matching and Trade Execution

CX2 accepts buy, sell, short sale and short-marking exempt orders from subscribers that are matched in real-time based on price/broker/time priority. Orders entered in CX2 that are not immediately matched are "posted" on the platform's Intelligent Order BookTM (IOB) which is dynamically updated in real-time with limit orders that are visible to market data customers. Quotations for orders posted in the CX2 book are attributed by default. However, Subscribers may also elect to have their orders be entered without attribution by selecting the anonymous order marker. All orders are eligible for broker-preferencing by default. However, subscribers may elect to opt-out of broker-preferencing on an order-by-order basis. When an order is elected to be ineligible for broker-preferencing it will neither seek the cross as an active order or be sought out to cross with by an active order eligible for broker-preferencing. Broker matching for anonymous orders is accomplished by using the underlying broker number. In this way, Subscribers can weigh the possibility of on marketplace internalization with the potential for a certain amount of information leakage. Jitney orders will not be eligible for broker-preferencing.

Trading Hours

Subscribers can trade in a continuous auction market between the hours of 8:30 a.m. and 5:00 p.m. (Eastern Time) on business days.

Securities Traded

CX2 will support trading in all Canadian equity securities initially offering trading in TSX and TSX Venture listed securities.

Market Data and Trade Reporting

CX2 disseminates order and trade information electronically in real-time using the same protocol as CXC. Level 1 and Level 2 market data feeds will be made available. CX2 market data feeds are provided independently of CXC data feeds. Initially customers may choose to receive either CX2's unicast or multicast market data feeds. Over time CX2's unicast market data feed will be fully migrated to CX2's multicast market data feed.

Order and trade information is also reported directly to the TMX Information Processor in compliance with National Instrument 21-101 and to IIROC for regulatory monitoring.

Order Types and Features

CX2 Traditional Order Types

Market Order -- An order to buy or sell a security at the best available price on CX2 but will not trade at a price outside the NBBO.

Limit Order -- An order to buy or sell a security at a price equal to, or better than, the specified limit price.

Short Sell Order -- An order to sell a security that the seller does not own (either directly or through an agent or trustee) at the time of the order.

Short-marking Exempt Order -- An order by an account to buy or sell a security that meets the definition of a short-marking exempt as defined by UMIR.

CX2 Advanced Order Types

Intentional Cross -- The simultaneous entry of both an order to buy and sell the same amount of a security at the same price entered by the same Subscriber. Intentional crosses are not eligible for broker-preferencing so that no cross interference occurs. In accordance with IIROC guidance on rules for dark liquidity, CX2 will accept better priced intentional crosses including those entered with a price of a half trading increment.

Internal Cross -- An intentional cross between two accounts that are managed by a single firm acting as a portfolio manager with discretionary authority in managing the investment portfolio.

Basis Cross -- A cross of at least 80% of the component share weighting of the basket of securities, index participation unit, or derivative instrument that is the subject of the basis trade. In accordance with UMIR, prior to execution, the subscriber shall report details of the transaction to IIROC.

VWAP Cross -- A VWAP cross is a cross of a security at the volume weighted average price of multiple trades on a marketplace or on a combination of marketplaces over a specified time period. The volume weighted average price is the ratio of value traded to total volume. In accordance with UMIR, where applicable, prior to execution, the subscriber shall report details of the transaction to IIROC.

Contingent Cross -- A cross resulting from a paired order placed by a Participant on behalf of a client to execute an order on a security that is contingent on the execution of a second order placed by the same client for an offsetting volume of a related security as defined in UMIR.

Bypass Order -- A Bypass order marker indicates that the user does not want the order to interact with undisplayed orders or undisplayed portions of iceberg or X-berg orders on the CX2 market. Orders marked with the Bypass marker are treated as IOC.

CX2 Sweep OrderTM (CSO) -- The CSO order marker indicates that the user has already checked the quotes of all other markets before routing the order to CX2. CSO orders are not re-priced by CX2's IOB. CSO orders will trade with the best priced contra-side order(s) without consideration of prices on other marketplaces. The CSO is designated as a Direct Action Order for OPR purposes as it permits a subscriber to opt out of CX2's OPR solution and take on direct responsibility for preventing trade throughs.

Post-Only Order -- An order that will post in the CX2 order book intended to provide liquidity. If the order upon entry would result in a trade, the order will be re-priced one tick increment more passively and booked. This order will not interact with hidden liquidity. Post-only orders may be combined with any other order type including non-displayed orders. Two contra side post-only non-displayed orders eligible to match will not execute. Instead, both orders will maintain their price until executing against an active order.

Iceberg/Reserve Order -- An order where a customer determines the number of shares to be displayed while the remainder is hidden in reserve. When the visible portion is fully executed, a new visible displayed size is refreshed, drawing from the amount of the reserve. New displayed sizes will refresh until the amount of the reserve is less than the displayed amount. At that point, the remaining reserve quantity will be displayed.

The X-berg -- An order that is similar to an Iceberg order. However, instead of the displayed size being the same every time the order is refreshed, the displayed quantity is chosen at random by the system within a pre-specified range set by the customer. A customer sets the amount of shares to be displayed and the amount of shares to held in reserve when first entering the order.

CX2 Non-displayed Orders

Minimum Quantity -- A Minimum Quantity order, such as All-or-None (AON), is an order that will only execute if there is sufficient demand or supply for the entire order. These orders are not displayed in the CX2 book.

Hidden Order -- A non-displayed limit order that adheres to the same execution priority conditions as other non-displayed order types.

Mid Peg Order -- The CX2 Mid Peg Order is a non-displayed order that floats at the mid point of the NBBO which is calculated and updated in real time by CX2's Intelligent Order Book. Mid peg orders also provide subscribers the option to enter a limit price with the order. Unique to this order type, when the NBBO spread is an odd increment, Mid Point Orders will execute at half penny prices. The Mid Peg Order is an ideal tool for Subscribers to reduce market impact and to be offered price improvement opportunities.

Execution priority -- Non-displayed orders will always execute after lit orders at the same price and then follow price/broker/time priority. Price priority for a re-priced non-displayed order is not affected by an underlying limit price. Time priority for a non-displayed order that re-prices is determined by the time that each re-pricing occurs. When re-pricing multiple non-displayed orders to the same price level, the time sequence for the re-pricing will be determined by each order's original timestamp or by the timestamp associated with the last re-pricing.

CX2 Peg Order Types

Primary -- A "Primary Peg" buy/sell order will peg to the passive side of the consolidated best bid/ask.

• Primary Peg orders can be entered as either displayed or non-displayed in the CX2 book, and subscribers will also have the option of entering a limit price with the order.

Mid -- "Mid Peg" orders are described above under "CX2 Non-displayed Orders".

Market -- A "Market Peg" buy/sell order will peg to the active side of the consolidated best ask/bid adjusted by a trading increment as defined by UMIR.

• Market Peg orders can be entered as either displayed or non-displayed in the CX2 book, and subscribers will also have the option of entering a limit price with the order.

• In order to prevent locked markets, Market Peg orders will book at the active side of the consolidated best ask/bid adjusted by a penny for securities priced equal to or greater than $.50 and by a half-penny ($.005) for securities priced less than $.50.

Peg Offset -- An increment/ decrement offset of the peg price that allows a pegged order to become more passive/aggressive than the quote to which it is pegged.

Example: a Primary Peg with a +$0.01 offset will peg to the consolidated bid price plus one cent.

Execution priority: Execution priority for non-displayed pegged orders follows the same execution priority that was described above for "CX2 Non-displayed Orders". Execution of any non-displayed pegged order or Hidden Order at the NBBO must also be in conformance with UMIR requirements that would allow for such executions. Execution priority for displayed pegged orders continues to follow price/broker/time priority with its price and time priority being affected by re-pricings in the same manner as described below for dynamically re-priced orders.

Pegged Order Handling

Between 8:30 a.m. and 9:30 a.m. Pegged orders will be accepted but will be held by the system until 9:30 a.m. Any pegged order entered before 9:30 a.m. will be "booked" in the market and become eligible for trading at 9:30 a.m.

From 4:00 p.m. to 5:00 p.m. All pegged orders entered after 4:00 p.m. will be rejected. Any pegged order that has been entered in the book before 4:00 p.m. will be cancelled at 4:00 p.m.

Chi-ControlsTM

Customer Command Center

The Customer Command Center is a web based application that provides CX2 subscribers with a risk management tool enabling them to monitor and disable order flow originating from clients that are directly accessing the market. The Customer Control Center includes the following features:

• Displays the number of open orders resting on CX2, sorted by trader ID;

• It allows the user to halt trading for an individual trader ID;

• It allows the user to halt trading for all registered traderID's of a designated client;

• It allows the user to re-start trading for any individual trader ID or combination of trader ID's.

Cancel on Disconnect

Subscribers have the option to have all open orders cancelled upon disconnection to CX2 ATS.

No-Self Cross

Subscribers may elect to not permit orders entered to execute against orders entered with the same firm trader ID. Orders that would otherwise result in a "wash trade" are cancelled.

Subscribers can choose one of the following implementations:

• Cancel the Active order

• Cancel the Passive order

• If the orders are different in share quantity, reduce the larger order and cancel the other one.

Customer Control Center

CX2 offers subscribers the following pre-trade risk management tools to monitor order flow:

• Price limit -- provides subscribers the ability to set price parameters for incoming orders. Price limits can be determined by either specifying a percentage band calculated from the last sale price (i.e. 10 percent above or below the last sale price) and/or by specifying fixed price levels for a security (ex. For a security trading at $6.00; a price ceiling of $9.00, and a price floor of $4.00). When an order is entered with a price that would violate a price parameter, the order will be rejected and sent back to the subscriber.

• Share limit -- provides subscribers the ability to set a maximum number of shares permitted per order per security. When an order is entered with a share amount that exceeds this limit, the order will be rejected and sent back to the subscriber.

• Capitalization limit -- provides subscribers the ability to set the maximum notional value per order per security. The notional value of a trade is calculated by the number of shares multiplied by the price of the security. When an order is entered with a notional value above this set limit, the order will be rejected and sent back to the subscriber.

Time in Force Conditions

IOC -- An "Immediate or Cancel" (IOC) order is one in which any portion of the order that is not filled immediately is cancelled.

FOK -- A "Fill or Kill" order must execute as a complete order as soon as it becomes available on the market, otherwise the order is cancelled.

DAY -- A Day order will remain live on the CX2 book for the duration of the trading day or until cancelled by the Subscriber. At the end of the CX2 trading day (5:00 pm Eastern Time) all outstanding, unfilled Day orders will be cancelled.

GTD -- A "Good 'Till Date" (GTD) order expires at the earlier of a specified Expire Time or the end of the trading day. At the end of the trading day (5:00 pm Eastern Time) all outstanding, unfilled GTD orders will be cancelled.

GTC -- "Good 'Till Cancelled" (GTC) orders will be cancelled at the end of the trading day.

Order Protection Rule (OPR) Features:

The following features are supported by CX2 to comply with the Order Protection Rule obligation.

Dynamic Order Re-pricing

Orders that are entered on CX2 that cross the National Best Bid Offer ("NBBO") and would either trade-through or quote-through a better priced protected order will be automatically re-priced to prevent a trade-through or crossed market from occurring. In addition, orders that are entered at the NBBO that would lock the market will also be re-priced. When an order is re-priced, its price priority after each re-pricing is determined by the price level to which it has been re-priced, while its time priority is determined by the time each re-pricing occurs. When re-pricing multiple orders to the same price level, the time sequence for the re-pricing will be determined by each order's original timestamp or by the timestamp associated with the last re-pricing.

Dynamic order re-pricing is available between 9:30 a.m. to 4:00 p.m. (Eastern Standard Time). Before 9:30 a.m. and after 4:00 p.m. (Eastern Standard Time), orders will be re-priced once and then have their price remain static. When an order has been re-priced outside of normal market hours, the order must be modified or cancelled and replaced in order to change the price of the order again.

Directed Action Order (DAO)

A Directed Action Order (DAO) informs CX2 that it can be immediately executed or posted without delay or regard to any other better-priced orders displayed on another marketplace. The order marker communicates that a check has been completed by the sender and that the obligation to execute against all better-priced orders will be assumed by the sender. CX2 designates the CSO order type as DAO for the purposes of the Order Protection Rule.

Clearly Erroneous Trade and Trade Amendment Policy

CX2 reserves the right to initiate a review of a clearly erroneous trade, regardless of whether or not a Subscriber request has been submitted, if it determines in its sole discretion that circumstances warrant such a review.

In such instances CX2 will notify the relevant Subscriber trading contacts, as provided by the Subscriber, via electronic mail or telephone as conditions warrant, that a trade will be reviewed pursuant to this policy. Market participants that are not relevant parties will not be notified that a trade is under review.

CX2 designated principals, with the consent of IIROC will exercise their sole discretion under this policy to cancel or amend a trade, where needed, that is the result of a CX2 system error or malfunction. Furthermore, CX2 will follow direction from IIROC to cancel, vary or correct a trade when IIROc instructs it to do so. In addition, CX2 will facilitate the cancellation or amendment of a trade when both counterparties to the trade agree to the trade cancellation or amendment. In this circumstance, notification will be made to IIROC. Decisions will be made in a timely fashion and in all cases a decision will be made no later than the close of business on the trading day of the occurrence which led to the review being initiated.

CX2 will promptly notify the relevant parties and IIROC via electronic mail, and telephone as conditions warrant, of its decision to cancel a trade or trades.

After CX2 processes the cancellation or amendment of any clearly erroneous trade, the trade is null and void.

Clearing and Settlement

All transactions executed are reported to CDS at day end for clearing. The CDS Participant Rules govern the operation of CDS clearing and settlement services.

All trades matched on CX2 will settle by default on a T+3 basis. In the case of a special direction for clearing and settlement, CX2 will make the appropriate adjustments to indicate the special clearing to CDS.